When working on federal public works construction projects there are no Stop Payment Notice or Mechanics Lien remedies available to protect subcontractors’ and suppliers’ right to payment. Instead, unpaid subcontractors and suppliers must resort to making a claim for payment under a federal law known as the Miller Act (40 USCS 3131 et seq.). Many claimants however, do not realize that the right to make a Miller Act claim is not available to all subcontractors and suppliers. Before committing to performing work on a federal project it is important for subcontractors and suppliers to understand whether or not a Miller Act claim will be available. For those who have no Miller Act rights, careful consideration must be given to whether it is worth the risk to take on the project. For those who have valid Miller Act claim rights, important deadlines must be considered.

WHO GETS PAID UNDER A MILLER ACT CLAIM AND WHO DOES NOT

For federal projects in excess of $100,000, contractors who have a contract directly with the Federal Government must obtain a Miller Act Payment Bond. The Bond is intended for the protection of subcontractors, laborers and material suppliers to the project.

As a general rule, every subcontractor, laborer, or material supplier who deals directly with the prime contractor and is unpaid may bring a lawsuit for payment against the Miller Act Payment Bond. Further, every unpaid subcontractor, laborer, or material supplier who has a direct contractual relationship with a first-tier subcontractor may bring such an action. The deadlines for these claims are described below.

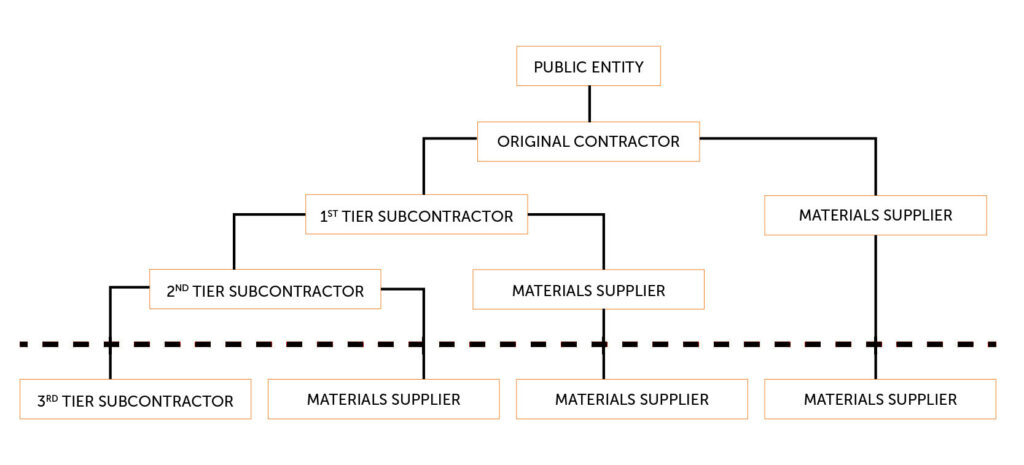

Among those who cannot bring a legal action on the Miller Act Payment Bond are third-tier subcontractors (see diagram below). In addition, suppliers to suppliers are also generally not entitled to a Miller Act Claim (See J.W. Bateson Company v. Board of Trustees, 434 U.S. 586 (1978)).

The diagram below is illustrative. In the diagram, only subcontractors and material suppliers ABOVE the heavy black dashed line can make a claim against the original contractor’s Miller Act Payment Bond. Those below the line are barred from making a Miller Act Claim:

WHAT CLAIMS DEADLINES APPLY?

Once a subcontractor or supplier determines whether they are entitled to a Miller Act claim, the next consideration is the deadline that applies for making such a claim. On federal projects within California (the property owner is one of the agencies of the Federal Government, e.g., Corps of Engineers, United States Army or Air Force, National Park Service, etc.) the general rules are as follows:

- If you are the original (prime) contractor, and you are not paid, you may bring a breach of contract claim is against the federal government. You cannot make a claim on the Miller Act Bond. Contact your attorney about filing a lawsuit.

- If you are a claimant who has furnished work or materials under a direct contractual relationship with the prime contractor:

- You can sue the prime contractor for breach of contract; and

- You can sue the surety on the Miller Act Bond posted by the prime contractor.

- Note that you must file suit no later than one year from the date you last furnished work or materials for the project (excluding warranty or repairs)

- If you are a claimant who only has a direct contractual relationship with a first tier subcontractor:

- You can sue the subcontractor for breach of contract; and

- You can sue the surety on the Miller Act Bond posted by the prime contractor. However, please note:

- You must serve a 90 Day Notice on the prime contractor no later than 90 days after you last furnished work or materials for the project. Fill out the form entitled Miller Act Notice For Federal Public Works Projects. It is best to send the completed form to the prime contractor by certified or registered mail. You must send it no later than 90 days after you last furnished work or materials to the project (excluding warranty or repairs). Remember to make a copy of what you send and save your proof of service by certified or registered mail.

- You must file suit no later than one year after the date you last furnished work or materials to the project (excluding warranty or repairs).

- If you are a claimant who only has a direct contractual relationship with other than the prime contractor or a first tier subcontractor (see diagram):

- You can only sue the person with whom you had a contract, usually for breach of contract.

- You have no right to make a claim against the Miller Act Bond.

The above information is very general and brief. Exceptions may apply. You should contact an attorney who practices construction law to obtain further and more detailed information. Please remember that all laws can and do change from time to time and the rules in effect this year may not be in effect next year. If you have questions, contact a knowledgeable construction attorney or reliable source, like www.AppliedLegal.com.

Article by William L. Porter, Esq. in 2024. Mr. Porter is a principal in Porter Law Group, Inc. in Sacramento, California. www.porterlaw.com.